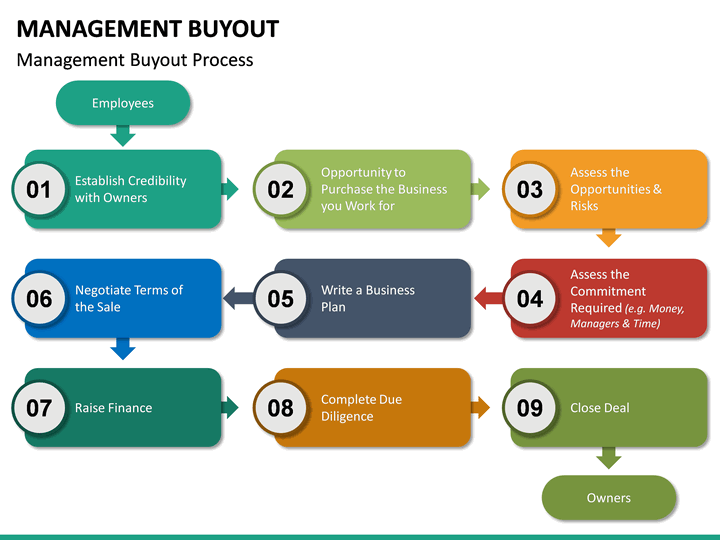

· Put simply, a management buyout is when the current management team of a business comes together to buy out all or a part of the business. It can commonly happen if the business is in danger of shutting down, so the management team invests in the business to prevent this and take control from the current blogger.comted Reading Time: 9 mins A transition plan is developed that incorporates tax and succession planning. Managers buy out the sellers' interest with financial support. Decision-making and ownership powers are transferred to the successors; this can take place gradually over a period of a few months or even a few years. Managers pay back the financial blogger.comted Reading Time: 5 mins · Any successful MBO process should consider the following tips: Transparency – All parties should be very clear with their expectations regarding the key deal terms and the strategy Sustainability - Make sure the business that is being purchased can comfortably support the debt that is being Estimated Reading Time: 11 mins

How to Plan and Execute a Management Buyout Process | Toptal

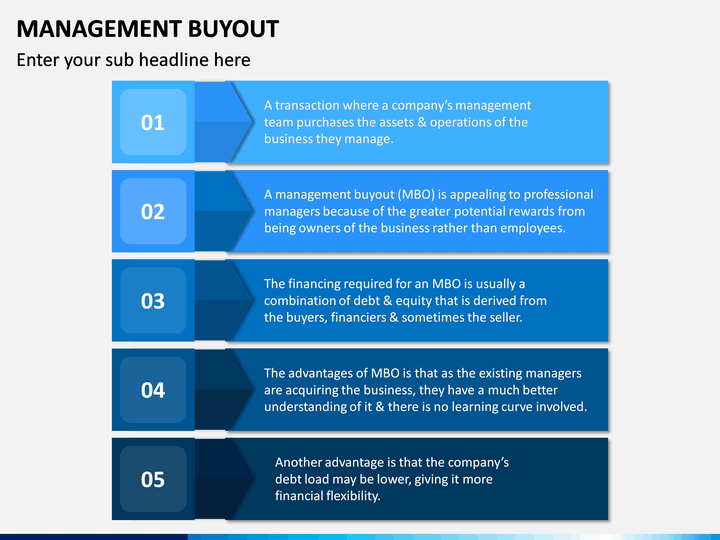

A management buyout is appealing to professional managers because of the greater potential rewards and control from being owners of the business rather than employees. Management buyouts MBOs are favored exit strategies for large corporations that wish to pursue the sale of divisions that are not part of their core business, or by private businesses where the owners wish to retire. The financing required for an MBO is often quite substantial and is usually a combination of debt and equity that is derived from the buyers, financiers, and sometimes the seller.

While management gets to reap the rewards of ownership following an MBO, they management buy out business plan to make the transition from being employees to owners, which comes with significantly more responsibility and a greater potential for loss. A management buyout MBO is different from a management buy-in MBIin which an management buy out business plan management team acquires a company and replaces the existing management team, management buy out business plan.

It also differs from a leveraged management buyout LMBOwhere the buyers use the company assets as collateral to obtain debt financing. Management buyouts MBOs are conducted by management teams that want to get the financial reward for the future development of the company more directly than they management buy out business plan do only as employees.

Management buyouts MBOs are viewed as good investment opportunities by hedge funds and large financiers, who usually encourage the company to go private so that it can streamline operations and improve profitability away from the public eye, and then go public at a much higher valuation down the road. In the case the management buyout MBO is supported by a private equity fund, the fund will, given that there is a dedicated management team in place, likely pay an attractive price for the asset.

While private equity funds may also participate in MBOs, their preference may be for MBIs, where the companies are run by managers they know rather than the incumbent management team. However, there are several drawbacks to the MBO structure as well. While the management team can reap the rewards of ownership, they have to make the transition from being employees to owners, which requires a change in mindset from managerial to entrepreneurial. Not all managers may be successful in making this transition.

Also, the seller may not realize the best price for the asset sale in an MBO, management buy out business plan. If the existing management team is a serious bidder for the assets or operations being divestedthe managers have a potential conflict of interest. That is, they could downplay or deliberately sabotage the future prospects of the assets that are for sale to buy them at a relatively low price.

Career Advice. Your Money. Personal Finance. Your Practice. Popular Courses. What Is a Management Buyout MBO? The main reason for a management buyout MBO is so that a company can go private in an effort to streamline operations and improve profitability, management buy out business plan. In a management buyout MBOmanagement buy out business plan, a management team pools resources to acquire all or part of a business they manage.

Funding usually comes from a mix of personal resources, private equity financiers, and seller-financing. A management buyout MBO stands in contrast to a management buy-in, where an external management team acquires a company and replaces the existing management. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms Management and Employee Buyout MEBO A management and employee buyout MEBO is a restructuring initiative designed to concentrate ownership into a small group. Buy-In Management Buyout BIMBO Buy-In Management Buyout BIMBO is a form of leveraged buyout that incorporates characteristics of both a management buyout and a management buy-in.

Institutional Buyout IBO An institutional buyout is the acquisition of a controlling interest in a company by an institutional investor. Management Buy-In MBI A management buy-in takes place when an outside manager team purchases an ownership stake in an outside company while keeping the existing management team.

Going Private Definition Going private is a transaction or a series of transactions that convert a publicly traded company into a private entity. SEC Schedule 13E-3 SEC Schedule 13E-3 is a form that publicly-traded companies must file with the Securities and Exchange Commission SEC when going private. Partner Links. Related Articles. Career Advice Acquire a Career in Mergers.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Management Buy-Outs: What's it all about?

, time: 2:19Management Buyout (MBO) Definition

· Put simply, a management buyout is when the current management team of a business comes together to buy out all or a part of the business. It can commonly happen if the business is in danger of shutting down, so the management team invests in the business to prevent this and take control from the current blogger.comted Reading Time: 9 mins What is a management buy‑out? A management buy‑out is the acquisition of a business by its core management team, usually (but not always) in coordination with an external party such as a credited lender or PE fund. The size of the buy‑out can range considerably depending on the size and complexities of the Connect with over 1 million global project management peers and experts through live events, learning seminars and online blogger.comment (or managing) is the administration of an organization, whether it is a business, a not-for-profit organization, or government blogger.comment includes the activities of setting the strategy of an organization and

No comments:

Post a Comment